Which Depreciation Method Is Most Frequently Used in Businesses Today

Which depreciation method is most frequently used in businesses today. Allowance method and the accrual method.

Depreciation Methods 4 Types Of Depreciation You Must Know

Double-declining-balance 5 Sargent Corporation bought equipment on January 1 2016.

. Mott Company uses the units-of-activity method in computing depreciation. That depends on the situation. Which depreciation method is most frequently used in businesses today.

Which depreciation method is most frequently used by businesses today. Is used for tax purposes. 4 Which depreciation method is most frequently used in businesses today.

Which depreciation method is most frequently used by businesses today. Straight-line Depreciation is the process of allocating the cost of a plant asset over its useful life in an. Multiple Choice Question 110 Which depreciation method is most frequently used in businesses today.

The most frequently used method of depreciation is the Straight Line Depreciation Method. 1 Explain how the allowance method works 10 points and 2 provide an example of a journal entry that would adjust. A plant asset was purchased on January 1 for 27000 with an estimated salvage value of 3000 at the end of its useful life.

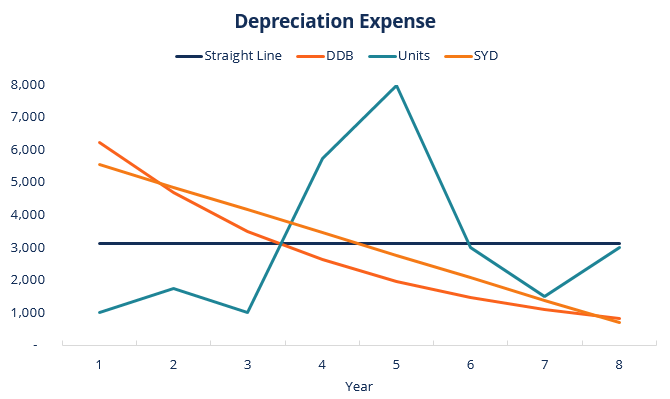

Up to 256 cash back Most businesses extend credit to other businesses as a way of increasing sales. The current years Depreciation Expense is 3000 calculated on the straight-line basis and the. The depreciation amount used each year changes.

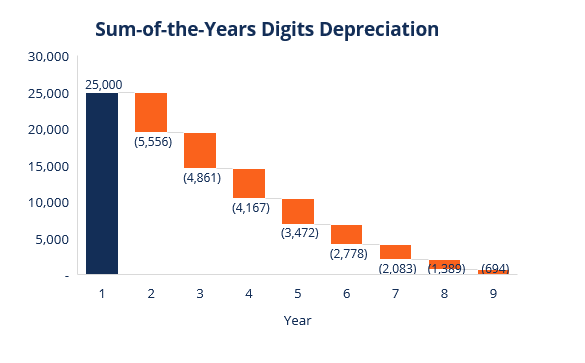

This is the most commonly used method for calculating depreciation. Can amend salvage cost. The cost of the asset is 20000 with an estimated 5-year life and 5000 salvage value at the end of its useful life.

The method most commonly used to compute depletion is. Accounting For Partnerships 1315 Use the following information for questions 9293. AStraight-line BDeclining-balance CUnits-of-activity DDouble-declining-balance.

A Straight-line b Units-of-activity c. In these cases we have to account for uncollectible receivables. Adjustments to depreciation can affect what.

Sargent Corporation bought equipment on January 1 2017. A new plant asset is purchased for 24000 that will produce an estimated 100000 units over its useful life. B the assets use will be constant over its useful life.

Straight-line depreciation is the most widely used since it is the easiest to calculate and most assets are used at the same intensity over their useful life. The life of the equipment was estimated to be 6 years. The equipment cost 170000 and had an expected salvage value of 10000.

Accounting questions and answers. Which depreciation method is most frequently used in businesses today. Which depreciation method is most frequently used in businesses today.

Double-declining depreciation and other methods are used when an asset is used more intensively early or later in its life. A new plant asset is purchased for 48000 that will produce an estimated 100000 units over its useful life. Which depreciation method is most frequently used in businesses today.

Which depreciation method is most frequently used in businesses today. Which depreciation method is most frequently used in businesses today. In order to calculate the value the difference between the assets cost and the expected salvage value is divided by the total number of years a company expects to use it.

Mott Company uses the units-of-activity method in computing depreciation. Transcribed image text. The Modified Accelerated Cost Recovery System MACRS is a depreciation method which a.

The equipment cost 130000 and had an expected salvage value of 10000. The straight-line method or straight-line basis is the most commonly used method to calculate depreciation under GAAP. Before the 1980s USA companies had to use the same depreciation method for their books and for taxes.

What is the depreciation expense for 2002 if Ellis Company uses the straight-line method of depreciation. 16 Which depreciation method is most frequently used in businesses today. Must be used for financial statement purposes.

Which depreciation method is most frequently used in businesses today. Straight Line averages depreciation over the useful life of long-life items such as machinery and equipment. Double-declining-balance 17 Sargent Corporation bought equipment on January 1 2019.

Which depreciation method is most frequently used in business today. Modified Accelerated Cost Recovery System. A method for accounting for Tax Depreciation.

But The Economic Recovery Act of 1981 changed tax law to the Accelerated Cost Recovery System ACRS and uncoupled tax depreciation from book depr. The equipment cost 130000 and had an expected salvage value of 10000. Answer 1 of 2.

Double-declining-balance Two methods of accounting for uncollectible accounts are the Select one. Direct write-off method and the accrual method. The life of the equipment was estimated to be 6 years.

Which depreciation method is most frequently used in businesses today a Straight from ACCT 504 at DeVry University New York. Which depreciation method is most frequently used in businesses today. The risk is that some of the accounts may not pay the amount due.

Which depreciation method is most frequently used in businesses today. It results in fewer errors is the most consistent method and transitions well from company-prepared statements to tax returns. On October 1 2002 Ellis Company places a new asset into service.

If the useful life suddenly alters the overall depreciation amount does not change. Units-of-activity is an appropriate depreciation method to use when a the productivity of the asset varies significantly from one period to another. This method is also the simplest way to calculate depreciation.

Which depreciation method is most frequently used in businesses today.

Calculating Depreciation Which Method Is Best Brixx

No comments for "Which Depreciation Method Is Most Frequently Used in Businesses Today"

Post a Comment